Greater Sacramento and the State of California offer a range of business incentives for those looking to relocate or expand. There are multiple programs at the local and state level offering tax credits, 奖助金, 人才援助, 加速许可和更多. 官方十大网投网址的团队 to learn more about these programs and obtain free assistance navigating the application processes.

加大萨克拉门托商业激励力度

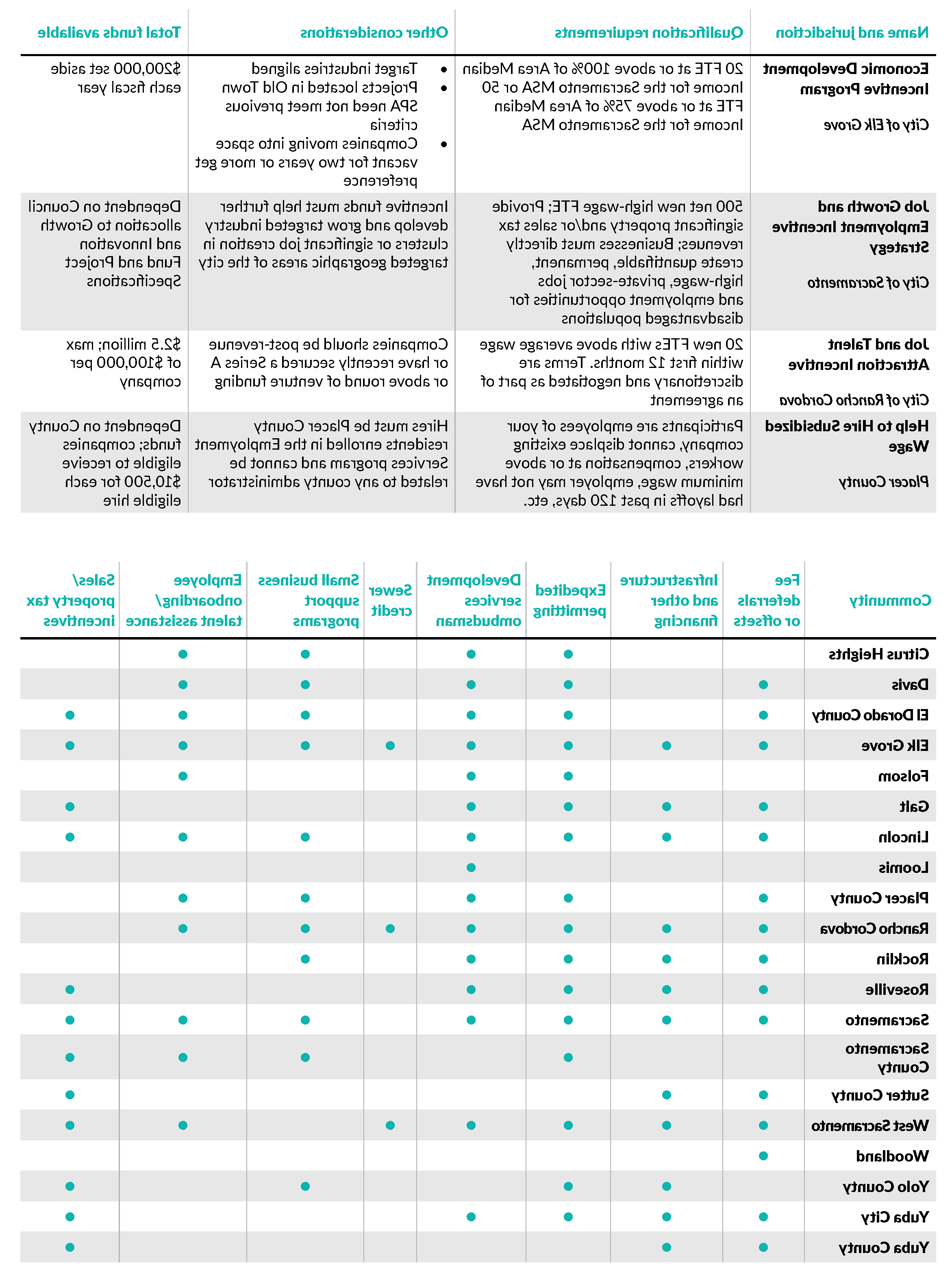

地方管辖激励措施

萨克拉门托公用事业激励措施

萨克拉门托市政公用事业区

官方十大网投网址速度

SMUD’s 官方十大网投网址速度 Program provides rate reduction over the first 10 years of a new project’s lifetime. Multiple options exist including a taper rate beginning at 6% in year one, 在第六年开始逐渐减少或持平.10年期间5%的利率折扣. Additional rate discounts are given to businesses located in disadvantaged communities. 费率是按每个项目发放的.

电气化和节能设计

SMUD’s electrification and integrated design incentives provide up to $250,000 toward energy efficient design for buildings and systems.

了解更多

工作场所电动车充电站补助金

This incentive 奖助金 $4,500 per handle toward installation of Level 2 EV chargers. SMUD also offers special low rates to commercial customers for PEV charging.

了解更多

PG&E

官方十大网投网址速度

For new business customers and existing customers looking to expand operations, PG&E offers an economic development incentive which provides a 12% discount on electricity for five years.

了解更多

十大网投官方入口商业激励措施

十大网投官方入口税收抵免和豁免

十大网投官方入口竞争税收抵免

The 十大网投官方入口竞争税收抵免 is available to businesses that want to locate in California or existing California businesses that want to stay and grow. The CalCompetes Tax Credit is awarded to individual businesses through a competitive application process and has up to three application periods each fiscal year. Credit awards are competitive and subject to credit availability. The tentative amount of credit available for allocation each year is $180,000,000. The amount any one business can request in tax credits must be at least $20,000, but no more than 20% of the total credit allocation available for the fiscal year.

访问CalCompetes网站 查看今年的指南

研发税收抵免

十大网投官方入口研究 & 开发(R&D)税收抵免计划减少了州所得税. A business may qualify for the credit if it paid for or incurred qualified research expenses while conducting qualified research activity in California. A business may receive 15% of the excess of current year research expenditures over a computed base amount (minimum of 50% of current year research expenses) or a 24% credit for basic research payments to third party organizations.

了解更多

制造业部分免征销售使用税

The partial exemption applies only to the state sales and use tax rate portion, currently at 3.9375%. Qualified companies are those engaged in manufacturing, 处理, 精炼, 制造或回收或从事R的公司&D for either biotechnology or physical, engineering and life science. The manufacturing equipment must be used at least 50% of the time for manufacturing purposes, must remain in California for at least a year and should have a useful year greater than one year. Purchases in excess of $200 million in any one year do not qualify.

了解更多

Advanced Transportation and Manufacturing Full Sales and Use Tax Exclusion

The California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) provides a full sale and use tax exclusion for advanced manufacturers and manufacturers of alternative source and advanced transportation products, 组件或系统.

了解更多

十大网投官方入口商业补助金

零排放车辆制造补助金

十大网投官方入口能源委员会已经批准了240美元,000,000 in 奖助金 for ZEV and component supply chain manufacturing, 包括燃料补给和电池制造. 每位获奖者将获得不超过5000万美元的奖金. Companies need to have a lease or purchase sales agreement signed. 需要从非政府来源获得10%的匹配.

了解更多

十大网投官方入口就业激励措施

新就业信贷

这项信用是为雇佣合格员工的雇主提供的, 全职员工, pay wages for work performed by that employee in a designated geographic area (DGA) and follow all proper reporting and filing requirements. The employer must have a net increase in jobs and must pay qualified wages, which amount to 1.是十大网投官方入口最低工资的5倍,但不超过3倍.是十大网投官方入口最低工资的5倍. Qualified employees must perform at least 50% of their labor within the DGA, must be employed full-time and must meet one of several additional criteria options. The total tax credit is equal to 35% of all qualified wages and can be used for up to 60 months.

了解更多

就业培训小组

The 就业培训小组 (ETP) provides funding to employers to assist in upgrading the skills of their workers. ETP uses a pay-for-performance contract to provide a specific, fixed-fee cash reimbursement for the costs of employer-customized, job-specific skills training conducted by a company and is inclusive of all administration and training costs. 合同的期限为两年. ETP funding is earned once the trainee completes a minimum number of ETP funded training hours and a post training employment retention period earning a contract specific wage.

了解更多

Get assistance identifying and applying for 大萨克拉门托和十大网投官方入口的商业激励

GSEC acts as a single point of contact for companies considering expansion in or relocation to the Greater Sacramento region, leveraging our expertise and existing relationships with state and local jurisdictions, 区域劳动力培训合作伙伴, utility service providers and others to help offset market entry and ongoing operational costs. We can identify all state and local incentives available to your business and help navigate the application processes. 我们所有的服务都是免费的. 今天就官方十大网投网址,了解更多信息.